Solar financing basics

- Factsheet

When it comes time to pay for your new solar system there are a number of choices to make. Each option has pros and cons and it is important to balance what best meets your needs. There are a number of similarities to buying or financing a car, so if you’ve been through that process, a lot of this will feel familiar to you. In addition to financing, see what national or state incentives are available to you.

For more in-depth information, please visit our Financing your new solar panels page.

Cash

The simplest method is to pay cash. Over the life of your system this will be the least expensive, but it will require a significant upfront investment. You will keep Solar Renewable Energy Credits (SRECs) (where applicable), but you’ll also be required to pay for any maintenance or repairs not covered by the warranties.

Pros

- Shortest payback period

- Maximizes money earned by your system

- State and local incentives

- SRECs

Cons

- Signifcant upfront costs

- Responsible for maintenance

Loans

If you prefer to finance the cost of your system there are several types of loans that will vary in their fees, total costs, and availability. These include home equity loans, home equity lines of credit (HELOC), state and federal programs, as well as credit union solar loans. For more on the specific types of loans, visit our main financing page.

Pros

- Less upfront cost

- Interest deductible for some types

- State and solar incentives

- SRECs

Cons

- Interest and fees will increase the payback period

- Responsible for maintenance

- Extra research and application time

Installer financing

Installer-based financers generally offer lower rates, but also charge higher finance or origination fees. Most of these options require credit scores of at least 640-650, but may have an easier application process since they are done through your solar installer.

Pros

- Easier process than other loans

- Less upfront cost

- Interest is deductible for some types

- State and local incentives

- SRECs

Cons

- Interest and fees will increase the payback period

- Responsible for maintenance

- Higher fees than other loans

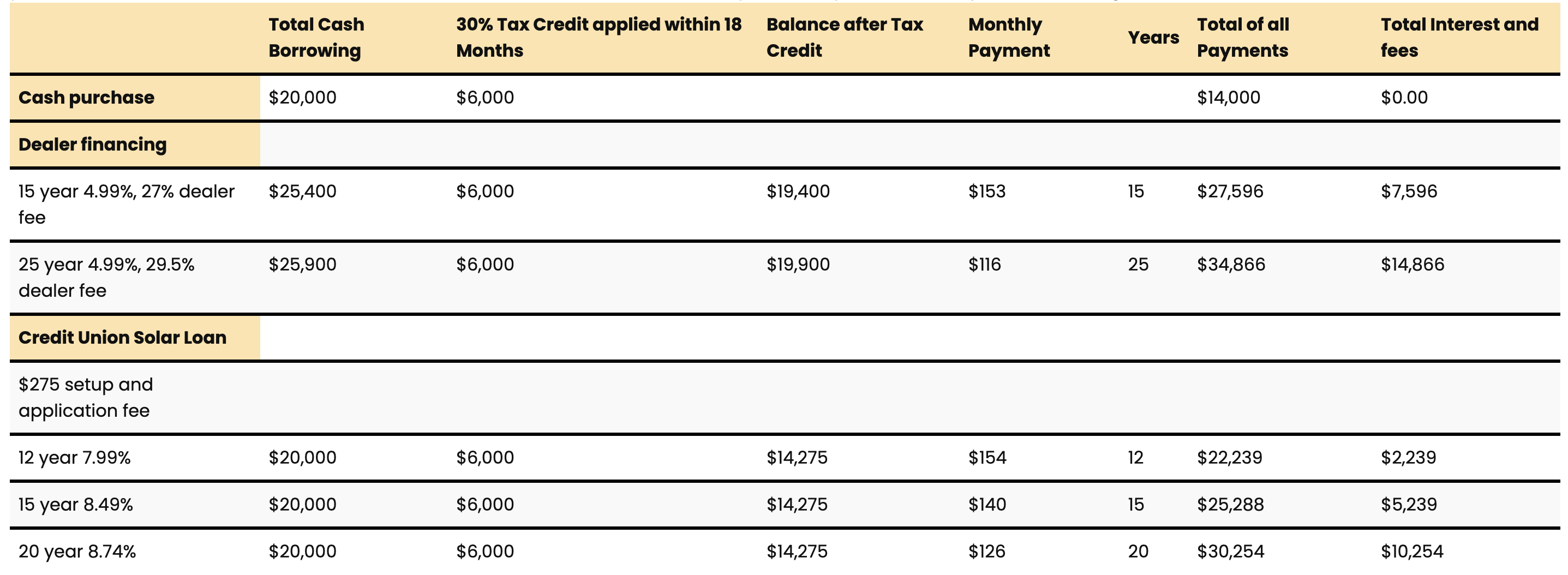

Below you’ll find a chart comparing a range of lenders, APRs, fees, and final costs of different types of financing and term lengths to compare with a cash purchase of a $20,000 system. In the Dealer Financing examples, the dealer fees are included in the Total Cash Borrowing amount.

According to the IRS, “Miscellaneous expenses, including interest owed on financing, origination fees, and extended warranty expenses are not eligible expenses when calculating your tax credit.” For further information on rules from the IRS, see this notice. As always, consult your CPA or tax professional for guidance.

Note: The tax credit expires at the end of 2025. Congress voted to repeal the 30% tax credit for solar. Click here to contact your members of Congress and share your support for solar energy. The safest way to ensure your installation will qualify for the tax credit is to have it completed and ready to be connected to the electric grid. (Note: SUN is not a tax advisor. You should consult a tax advisor to determine the extent to which your installation is eligible.)

Here are some loan calculators that are free to use and can help you calculate the total interest on your loans:

There is no perfect loan and ultimately the right choice for you will involve deciding what is most important for you:

- Lowest monthly payment

- Lowest dealer fee/origination fee

- Lowest amount of total interest paid

Third-party ownership

An alternative to loans or outright purchasing a system is a Third-Party Ownership (TPO) agreement. This is a financial option that allows homeowners to install a system on their roof, with minimal upfront costs. With this type of option, the homeowner does not own the equipment. TPOs are traditionally broken down into Power Purchase Agreements and Solar Leases, and while both options are used interchangeably, there are key distinctions which are addressed below.

The residential solar tax credit expired at the end of 2025. If buying a system outright or through loan financing, homeowners will no longer be able to qualify for the credit. However, third party ownership models (solar leases and power purchase agreements) qualify under the commercial tax credit. This is still in effect through 2029. In these cases, the system owner would be eligible for the federal tax credit as long as certain requirements are met. Your solar installer will be able to let you know if your system qualifies.

Pros

- Little to no upfront costs

- No maintenance costs

Cons

- Long contract term can complicate home sale

- No SRECs

- No state or local incentives

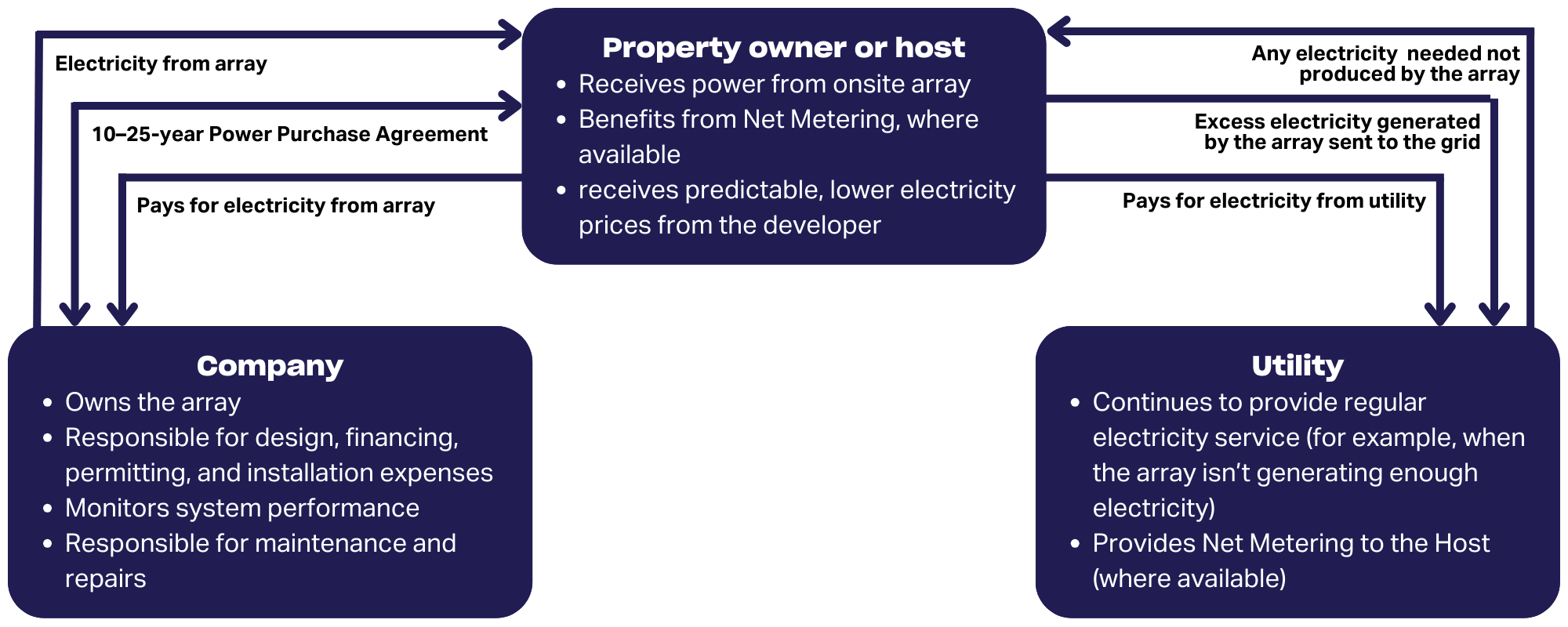

Power purchase agreements

A PPA is an agreement where a solar company installs and owns the panels on your roof. You agree to purchase the electricity they generate—usually at a rate lower than your utility. PPAs are not legal in all states.

How it works

- $0 upfront cost

- You pay monthly based on solar production

- The rate is often lower than utility rates

- Provider owns and maintains the system

- Provider takes commercial federal tax credit (48E)* and any other available incentives

- Provider is responsible for maintenance, repairs, and monitoring

- You still benefit from the value of any exported electricity

- Contract terms typically run 15–25 years

- Since you only pay for what the system produces, PPAs often don’t have production guarantees.

* The federal tax credit for homeowners paying cash or financing with a loan ended in 2025 but commercial owners can still use a tax credit. See “Understanding the 48E Investment Tax Credit” for more.

Pros

- Savings from the first day

- No maintenance responsibility

- Ideal if your priority is lowering your monthly bill without taking on ownership

- Battery advantage: if included, would have a full-length warranty instead of a common 10-year warranty.

Potential Drawbacks

- Payment can vary month to month depending on sun/production

- Long-term contract

- Escalators may increase the price each year which can impact your savings.

- Can complicate selling your home

- You don’t receive any of the available financial incentives

- PPAs are not straightforward in states without net metering, such as California. You may be paying a rate for your electricity greater than the value of the electricity that you export to the grid. In this case, a battery would be key to realizing savings.

How a purchase power agreement works

Solar leases

A solar lease is similar to a PPA—you don’t own the system—but you pay a predictable monthly fee rather than paying for electricity output.

How it works

- $0 or low upfront cost

- You pay a fixed monthly lease amount

- Provider owns and maintains the system

- Provider takes commercial federal tax credit (48E)* and any other available incentives

- Provider is responsible for maintenance, repairs, and monitoring

- You still benefit from the value of any exported electricity

- Contract terms typically run 15–25 years

- System buyout options are sometimes available after year 5 of the contract

- Most solar leases have production guarantees to make sure you get a credit if your system isn’t working well or is down for maintenance.

* The federal tax credit for homeowners paying cash or financing with a loan ended in 2025, but commercial owners can still use a tax credit. See “Understanding the 48E Investment Tax Credit” for more.

Pros

- Predictable monthly cost

- No maintenance responsibility

- Ideal if your priority is lowering your monthly bill without taking on ownership

- Battery advantage: if included, would have a full-length warranty instead of a common 10-year warranty.

Potential Drawbacks

- You pay the same monthly fee even if production drops

- Escalators may increase payments annually, which can impact your savings

- You don’t receive any of the available financial incentives

- Can complicate selling your home

Prepaid leases

How Prepaid leases work

- You make a large upfront payment (this is similar to a cash solar purchase)

- You lower your electric bill

- The third-party system owner still owns and maintains the system

- The system owner claims available tax credits and other available incentives

- System buyout options are sometimes available after year 5 of the contract

- Be sure to read the “What is a Lease” section for the rest of how leases work

Potential Benefits

- Lower total cost than a monthly lease

- Lower cost than purchasing since the system owner can take advantage of depreciation and the commercial tax (48E) credit*

- No monthly solar payment

- Maintenance and repairs covered

- Predictable long-term savings

- Battery advantage: if included, would have a full-length warranty instead of a common 10-year warranty.

* The federal tax credit for homeowners paying cash or financing with a loan ended in 2025 but commercial owners can still use a tax credit.

Key Considerations

- Significant upfront payment

- While many leases have production guarantees in case the system stops functioning, if you’ve paid the entire amount upfront, you as the customer no longer have any financial leverage (i.e. stopping a monthly payment) should you run into any difficulty with the system owner.

- Savings depend on how long you stay in the home

- Pre-paid leases are usually designed so that the system owner can take advantage of tax credits, depreciation and other available incentives and lower the price to the homeowner.

Key distinction between PPAs and leases

Although both tools require zero down-payment and cover the upfront costs for the system, there is one major difference between the options.

In a PPA, a customer’s monthly payment is dependent on the system’s output and varies across the year. With a lease, however, the monthly payment fee remains uniform throughout the year. With a lease in particular, it is important to pay attention to a production guarantee and to see if you are still required to make payments if your system is not working and you are waiting on maintenance from the system owner.

General financing notes

While exploring any financing options around your solar installation, we recommend that you get multiple offers from various parties before making any formal commitments. You can evaluate the proposals based on what’s most important to you. Some of the variables you may want to consider include the following:

- Monthly payments (preference for smaller payments over a longer period)

- Amount of interest accrued or paid over the length of the contract

- Length of time for loan payback

- Any financing or miscellaneous fees stated in the contract. These fees are typically interest rate buydowns such as a 20% additional finance fee to lower an interest rate from 7.99% to 3.99%.

- Interest rate buydowns may be helpful if you are planning on making payments over a long period of time but they will often cost you more money if you are planning on paying back your loan faster.

Key terms and concepts

Term Length: Leases and PPAs for residential solar customers are typically 20-25 years in length. This is in line with the guaranteed lifetime of the panels.

Annual escalator(s): Given the length of these contracts, factors like inflation and the market price of electricity will definitely increase over time. It is safe to assume that the company will include an escalator which increases the lease rate or rate per kWh by select amounts annually. This is usually expressed as a yearly percentage increase and it is important to understand how that will change your monthly bill over time.

Maintenance: Solar systems are fairly robust and low-maintenance over their lifetime (25-30 years). In the event that something goes wrong or the panels break down, it is important to know who is responsible for maintenance or repair work and whether or not there is a cost to the customer.

In a PPA or Lease, it is important to know who will be responsible for regularly monitoring the system’s performance to ensure it is performing within the metrics and standards stipulated on the contract.

Production Guarantee: Some installers will offer a production guarantee that your system will produce a certain amount of energy within a certain time period. The specifics will vary from installer to installer, so it’s important to understand what the threshold is and how it’s spread out over time, as well as how they will fix the problem or compensate you in the event your system is underperforming.

Early purchasing of the system: For both a solar lease and a PPA, customers sometimes have the option to buy their systems instead of leasing the system for the full predefined contract term. While some contracts provide a predefined price for the system, others offer the option of soliciting the services of a third party appraiser and determining a fair value through them.

End of term options: Once a customer’s lease or PPA comes to an end, they have the option to buy the system from the third party, extend the agreement and negotiate new rates, or ask for the system’s removal from their property.

Moving: Whether you own your system, lease your system, or have a PPA, selling your home can add some complexity to your sale. Download our free guide to Selling Your Solar Home and get information to help.

Get the latest on solar straight to your inbox.

Fight for your solar rights.

Everyone has the right to go solar. Spread the sunshine nationwide and in your local community by taking action, joining events, and more.