Solar Renewable Energy Credits (SRECs)

- Factsheet

What is an SREC?

A Solar Renewable Energy Credit (SREC) represents the “green” value of your electricity. SRECs are sold separately from the physical electricity that your solar panels produce. Think of them like a “voucher” that proves the electricity from your solar panels is renewable. You earn one SREC for every 1,000-kilowatt hour (kWh) or 1 megawatt-hour (MWh) of electricity produced by your solar array.

SREC “vouchers” are valuable because many utilities must buy a certain number of them each year to meet sustainability requirements set by the renewable portfolio standard (RPS) in each state. In some cases, corporations are also interested in offsetting their carbon emissions by purchasing these credits.

Why do we have SRECs?

SRECs exist everywhere, but they can’t always be sold easily. Some states have passed legislation called renewable portfolio standards (RPS). These laws require utilities and/or other energy suppliers to source a certain percentage of the electricity they generate or sell from renewable sources. If the standard is not met, they are subject to fines called Alternative Compliance Payments (ACPs). RPS laws generally apply to many types of renewable energy, including wind and solar.

As part of the RPS, legislation can implement a “solar carve-out” requiring a certain amount of renewable power to come from solar and sometimes require that solar be generated in that particular state. Utilities can secure this solar power by building their own solar projects or by purchasing the renewable energy credit on an open SREC market. The utilities can use these purchased credits to fulfill the RPS solar carve-out requirements. Once you’ve installed solar, you can sell the SRECs you generate into this market.

Help more people go solar

Help more people go solar, join together, and fight for their energy rights.

How much are SRECs worth?

Utilities and suppliers subject to the RPS can meet the standard in several ways. They can generate or buy the required renewable energy themselves. Or, they can purchase renewable energy credits (RECs) from renewable energy owners. This includes homeowners who have solar on their roofs. So, your SRECs are worth money when utility companies buy RECs rather than build their own solar farms.

In markets with Renewable Portfolio Standards, the price of these RECs is determined by two factors:

- The price of the Alternative Compliance Payment (ACP), and

- The supply of RECs on the market.

The ACP is the penalty utilities and/or suppliers would pay for not meeting the RPS. These companies buy RECs on a market, similar to stocks. The price of a REC is determined by supply and demand. The more RECs available on the market, the lower their cost.

What’s more, the ACP sets a price ceiling. The price of a REC won’t go higher than the ACP because the utility would find it less expensive to pay the ACP.

In areas without a legislatively established SREC market, these credits can still have value on “voluntary markets” but they are usually much less.

SREC prices change

Because SRECs are bought and sold on an open market, several factors influence their price. The more demand for SRECs there is from utilities, the higher the price. On the other side, as the supply of SRECs on the market rises, the price drops.

The SREC market can change at any time, and the price changes depend on the supply of SRECs. Think of the SREC market like the stock market—it can fluctuate.

It is also important to understand that each state has a different renewable portfolio standard (RPS), and therefore the value of SRECs will change from state to state. Make sure to learn about your state’s SREC market when deciding whether to go solar.

How many SRECs will my system produce?

Your system will produce one SREC every time it produces a megawatt-hour (1,000 kWh) of electricity. The amount of megawatt-hours produced depends on your geographic location and on-site factors, such as the way your solar panels are pointed and how much shade there is.

1,000 kWh of electricity = 1 SREC

As a very rough rule, you can estimate the number of SRECs your system will produce by multiplying the size of the system by 1.2. For example, a 5-kilowatt system will produce approximately 6 SRECs each year.

How do I sell my SRECs?

Step #1: Register your system

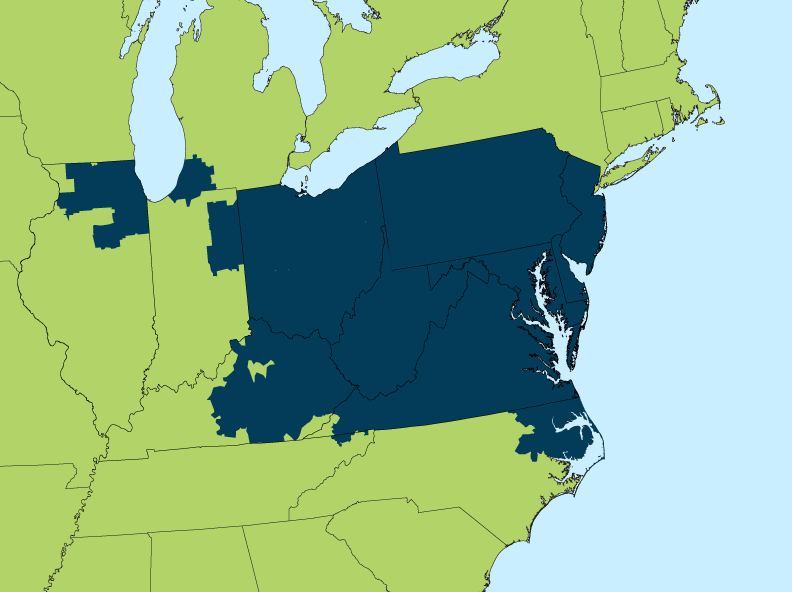

(Note: this explanation pertains to the sale of SRECs in the PJM territory, see map below. If you live outside this area, consult SRECTrade.com)

Many solar installation companies take care of SREC registration for you. They will register your system with your Public Service Commission and then submit the registered system to the Generation Attribute Tracking System (“GATS”) administered by PJM. PJM is a regional transmission organization that manages the electric grid for 13 states and the District of Columbia.

If your installer doesn’t register your system for you, you can hire an SREC company. SREC companies can often complete the registration process on your behalf. See the PJM website for a full list of aggregators and brokers serving each state. Some companies Solar United Neighbors members commonly use include:

- Flett Exchange

- SolSystems Currently offering discounted pricing to Solar United Neighbors network members in some states.

- SREC Trade

- RECmint (DC, MD, VA, PA)

- Carbon Solutions Group (including non-PJM states of CA, OR, TX, & WA). Currently offering discounted pricing to Solar United Neighbors network members in some states.

Step #2: Choose how you want to sell your SRECs

Once you’re registered, you can sell your SRECs. You have three options:

- Sell the rights to all your system’s SRECs for an upfront payment.

- Sell your SRECs via a contract for a set period of time, usually three, five, or 10 years.

- Sell your SRECs on the spot market as you produce them.

Upfront payment

- Sell the rights to all of the SRECs that will ever be produced by your system.

- Get a single, lump sum payment upfront.

After that, you receive no money for SRECs for the lifetime of your system.

Pros:

- Reduces the out-of-pocket cost of your solar system

- Eliminates all market risk of future SREC price fluctuations.

- You know exactly how much you will get from your SRECs and aren’t exposed to any market uncertainty

Con:

- It earns significantly less for your SRECs than other options.

Best option if:

- You don’t have enough upfront cash to purchase the system.

- You don’t want to take on any risk related to future SREC price fluctuations.

SREC contract

- You sign a contract with an SREC aggregator for a set period of time, usually three, five, or 10 years, and lock in a price for your SRECs.

- Every time your system produces an SREC, the aggregator issues you a check

- Aggregator sells your SRECs for you and takes a small portion of the proceeds.

Pros:

- It locks in SREC prices for a set period, protecting you from market fluctuations

- You know how much you’ll earn for your SREC and can plan your finances accordingly.

- If prices for SRECs drop unexpectedly, you’re protected from losses.

Cons:

- You don’t start earning SREC income until after your system produces power, which doesn’t help reduce the upfront cost of going solar.

- The longer your contract, the less you earn per SREC. SREC aggregators take on more risk with a long-term contract & charge you accordingly.

- Locked into a price, you may miss out on income if prices rise unexpectedly.

Best option if:

- You want to know exactly how much you will earn from SRECs over the length of your contract, and you want to avoid fluctuations in SREC by locking in a single price.

SRECs on the spot market

- Sell SRECs on the open market periodically as your system produces them.

- Must sell SRECs within three years of producing them

Pro:

- You maximize your potential earnings from SRECs.

Cons:

- You take on the most risk that future SREC prices will fall.

- You manage the SREC account and decide when to sell SRECs.

Best option if:

- You want to maximize return on SRECs but are willing to take on the risk that prices will drop unexpectedly.

Who owns the SRECs?

If you are considering a lease or power purchase agreement (PPA) rather than purchasing a system, find out who controls the SRECs. Typically, in PPA and lease deals, the solar company will keep the system’s SRECs. If you are paying cash or financing with a loan, you are the system owner and should also retain rights to your SRECs. In some cases, utility solar rebate program rules may transfer ownership of your SRECs to the utility.

Take action

Discover the issues we’re fighting for in your area, and help us build a new energy system that puts power in the hands of the people.

Get the latest on solar straight to your inbox.

Fight for your solar rights.

Everyone has the right to go solar. Spread the sunshine nationwide and in your local community by taking action, joining events, and more.