Presbyterian Church of Okemos – MI

- IRA,

- Stories

Federal incentives streamline solar savings for Okemos congregation

By: Gabe Hutchison

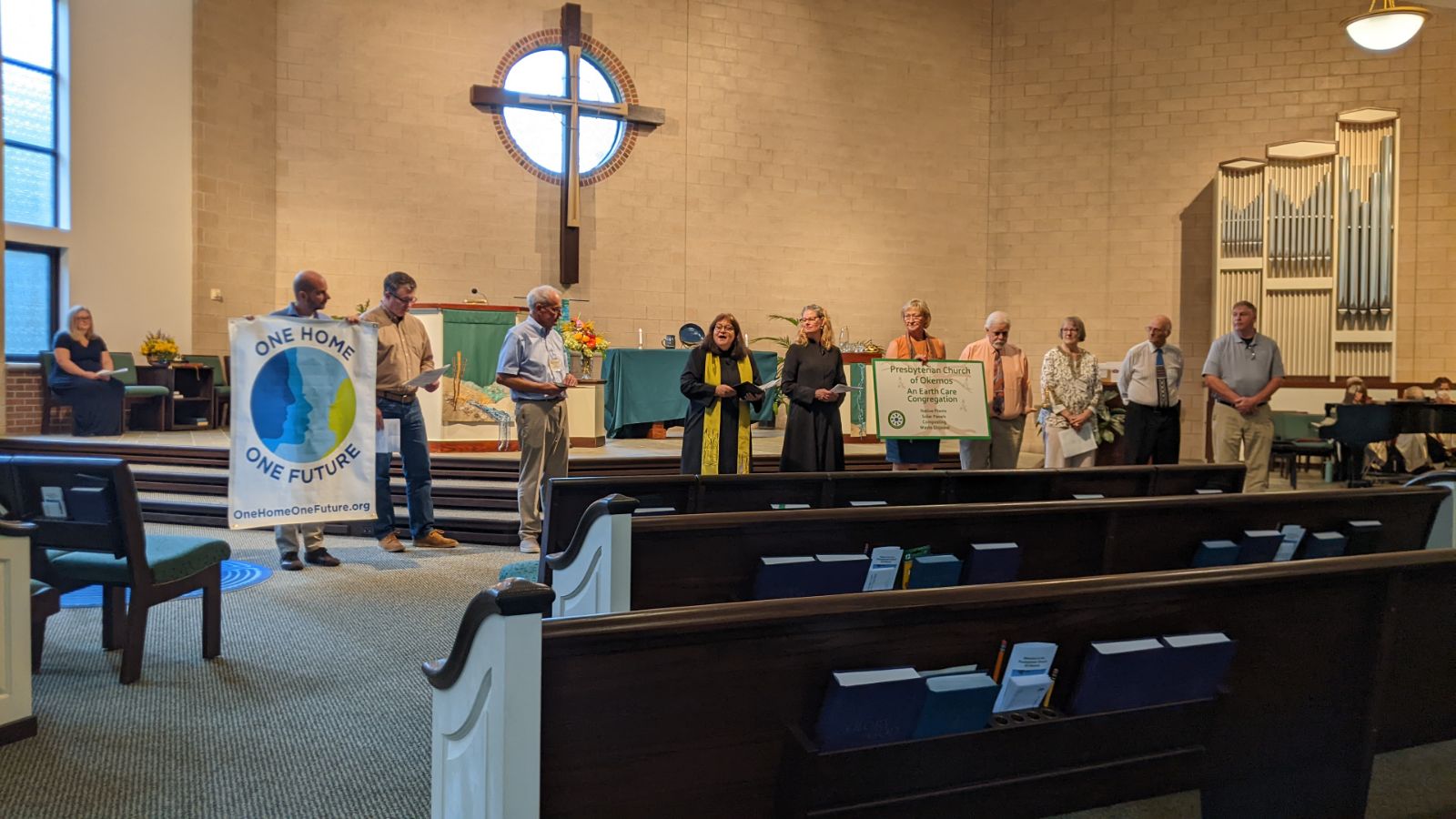

Revered Lisa Schrott became Pastor at the Presbyterian Church of Okemos in Okemos, Michigan, in 2021. Upon joining the church, she was quickly introduced to the congregation’s Green Team, who shared their desire to install a solar array. Lisa not only supported the idea but was thrilled to hear the project was already in motion.

“Our main reason for doing this was that we are called to be good stewards of God’s creation,” shared Lisa. By producing their own renewable energy, they would be living into that call. In addition to stewardship, the financial benefits would support their operations and enable them to have a greater impact in their community.

To meet its energy needs, the church would need to install a 40-kilowatt solar array. The 100-panel system had a total cost of $86,800, prompting them to launch a capital campaign that successfully raised $21,000. To cover the remaining expenses, they planned to take a loan from a bequest left to the church and establish a Limited Liability Company (LLC).

When the church began the project in 2021, tax-exempt entities were not eligible to directly receive federal solar tax credits. Forming an LLC is one way they could still benefit, which would require the church to set up a separate entity and navigate legal and tax regulations. The LLC would own the solar panels and sell the power back to the church, allowing the LLC to claim the tax credit and pass on savings. While this approach can reduce solar costs, it is a complex process that requires ongoing oversight. Even so, these savings were essential for the church so they planned to move forward.

In 2022, the Inflation Reduction Act (IRA) eliminated the church’s need to pursue this avenue through its Direct Pay provision. Now tax-exempt entities can receive the equivalent amount of the 30% Investment Tax Credit (ITC) as a direct payment from the federal government.

Jeff Arbour, chair of the Green Team, vividly remembers driving in the car with his wife when he first learned about the advent of the new incentive, “The solar rep called me up with news about the Direct Pay, and I said, ‘Pull over! Pull over! We’ve got to talk here.’”

The church dropped plans for an LLC in favor of Direct Pay. “This is so much cleaner,” said Jeff. Lisa agreed, “There would have been a lot more paperwork involved with the LLC. The church would not have owned the panels, the LLC would have owned the panels and then we would be paying off the LLC over time.”

This would have also made the array difficult to insure. “That was something that had not really registered—that if [the system] was owned by an LLC and on our property, the insurance would be different than if we owned it outright. And so, the Inflation Reduction Act really streamlined a lot for us,” Lisa reflected.

With an additional $25,980 in financial support through Direct Pay, the church installed a ground-mounted array in March 2023. The panels will save the church $6,000 per year in electricity costs, helping them to pay back the cost in about seven years. “From then on it will be free and clear—Just all free clean energy,” said Jeff. Once they’ve paid off their loan, the church plans to put their savings towards helping other faith communities and nonprofits go solar themselves.

The 100-panel array is prominently visible to anyone driving past the church, a benefit of choosing a ground-mounted system. “It is an evangelism tool and we do have people that have come to the church because they have seen the solar panels,” said Lisa. “It turned out to be an important part of our decision-making for putting in a ground-mount unit… it is a witness to our theological beliefs to the community.”

The church is excited to be a source of distributed renewable energy, and for the message it sends about their congregation. Thanks to the IRA the church can focus on the impact they hope to have, instead of jumping through hoops to overcome financial barriers. “I am really grateful that they have extended this to allow nonprofits to benefit,” Lisa said.

Get the latest on solar straight to your inbox.

Fight for your solar rights.

Everyone has the right to go solar. Spread the sunshine nationwide and in your local community by taking action, joining events, and more.