How the Inflation Reduction Act helps you and your community go solar

- Factsheet

The Inflation Reduction Act of 2022 (IRA) may be the most important pro-solar law Congress has passed.

For prospective solar owners, the most important piece is the extension of the 30% federal tax credit for residential solar. Beyond that, the bill contains many provisions that will help you and your community go solar and take control of where your energy comes from.

The IRA benefits everyoneThe IRA benefits everyone

The IRA will result in substantial energy savings and economic and health benefits for American families and businesses.

According to White House projections, it will:

- save families that use the bill’s tax incentives more than $1,000 each year,

- enable 7.5 million families to install solar on their properties,

- create millions of well-paying jobs, and

- prevent up to 3,900 premature deaths and up to 100,000 asthma attacks annually by 2030 due to the reduction of fossil fuel pollution.

Further, Rewiring America estimates that families could save $1,800 each year with an electric heat pump for HVAC and hot water, an electric vehicle, and solar panels.

Be sure to check out the full White House guide for more information on the Inflation Reduction Act.

Increased affordability for homeownersIncreased affordability for homeowners

The IRA restores and extends federal solar tax credits. This includes the residential Investment Tax Credit (ITC). Thanks to the bill, homeowners who install solar between the start of 2022 through the end of 2032 will be able to deduct 30% of the cost from their federal income taxes. If you owe less than that amount in federal taxes for the year you install your system, you can carry over any unused credit to the next year.

After 2032, the residential ITC will start to phase out. It drops to:

- 26% in 2033

- 22% in 2034

- 0% for 2035 and beyond

New tax benefits for nonprofits

Before the IRA, entities that don’t pay taxes (churches, schools, and charities) were unable to benefit from solar tax credits. The IRA changes this.

Tax-exempt organizations can now benefit from federal solar incentives through a new “direct pay” option. This applies to solar systems installed between 2023 and 2034. Direct pay allows these groups to receive cash payments in lieu of tax deductions. It applies to nonprofit organizations, private nonprofit and public schools, faith-based organizations, local and state governments, tribal governments, and rural electric cooperatives.

Learn more on our Solar for Nonprofits page and in the IRS Direct Pay guidance.

Commercial credits for businessesCommercial credits for businesses

The IRA extended and lifted commercial tax credits for solar. This enables businesses to continue benefiting from tax savings. Commercial projects can take advantage of either the commercial Investment Tax Credit (ITC) or the Production Tax Credit (PTC).

Small commercial projects (under 1 MW) now qualify for a base ITC of 30% through 2033.

These projects can also earn additional credits:

- + 10% for meeting domestic content specifications

- + 10% if at a brownfield site or in a community directly impacted by fossil fuels

- + 10% if in a low-income community or on tribal land*

- + 20% if part of a Low-Income Residential Building Project or Qualified Low-Income Economic Benefit Project*

Larger commercial projects qualify for a base ITC of 6% through 2033. This increases to 30% if certain labor requirements are met.

These projects can also earn additional credits:

- + 2% for meeting domestic content specifications (or 10% if labor requirements are also met)

- + 2% if at a brownfield site or in a community directly impacted by fossil fuels (or 10% if labor requirements are met)

- + 10% if in a low-income community or on tribal land*

- + 20% if part of a Low-Income Residential Building Project or Qualified Low-Income Economic Benefit Project*

*Businesses must complete and submit applications for these particular credits. These applications need to be approved for the business to receive the credits. In some cases, the process is competitive.

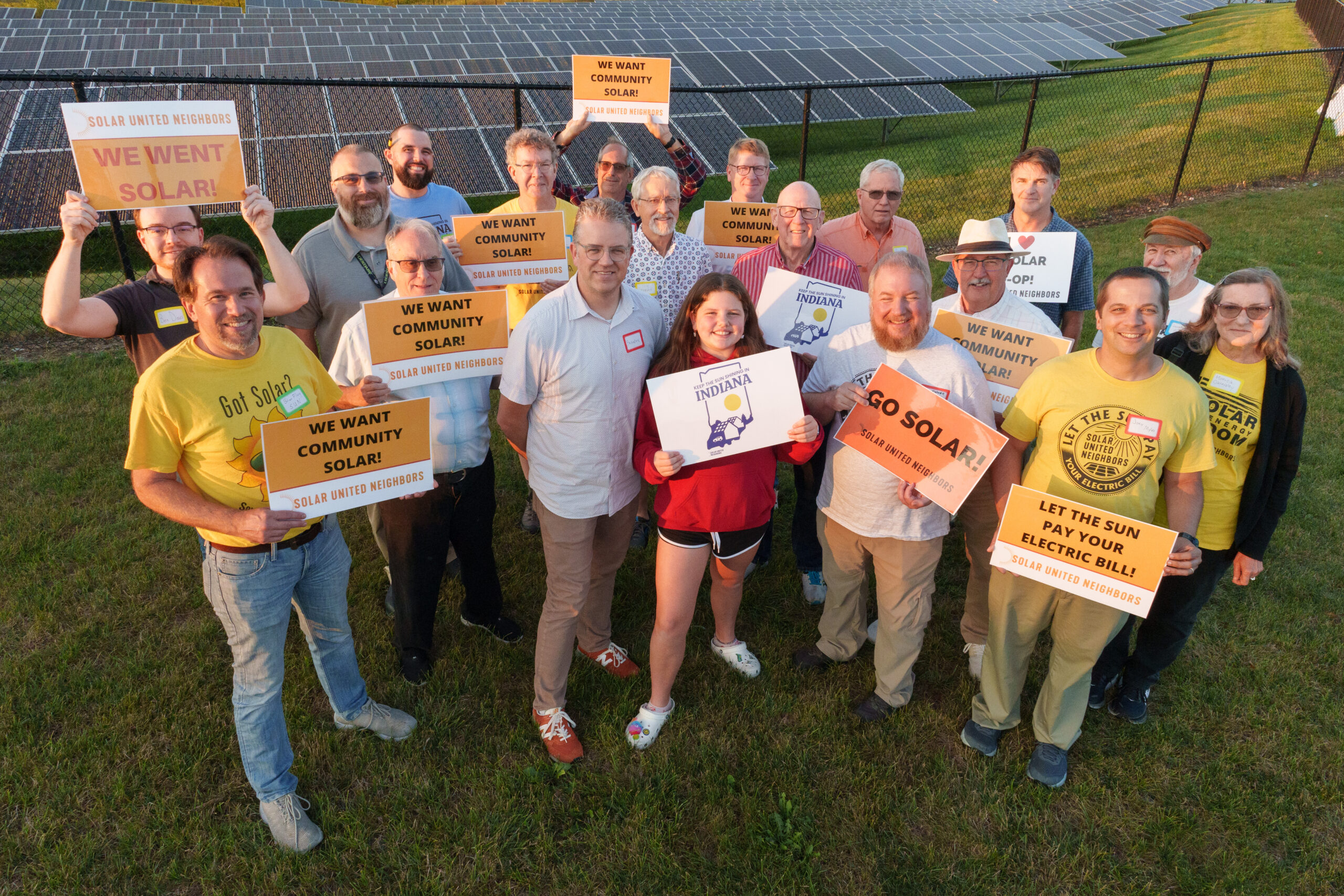

More community solar optionsMore community solar options

The IRA extends and expands tax credits for community solar projects. These are solar installations that allow people to buy or lease a share of a project. Participants then earn credit off their electric bill based on the amount of electricity their share generates.

The IRA enables community solar projects to benefit from the same commercial credits as other businesses. These credits are especially helpful for small-scale, equity-focused community solar. These credits will result in more community solar projects being built and more Americans saving with community solar.

Energy efficiency and electrificationEnergy efficiency and electrification

The IRA includes a variety of incentives to help you and communities across the country use less electricity and use it from cleaner sources.

The bill provides:

- Tax credits for home electric heat pumps and certain home electrical upgrades (more details).

- Nearly $8.8 billion for State Energy Offices and Indian Tribes to establish rebates for home efficiency and electrification upgrades.

- Tax credits of up to $7,500 for new and up to $4,000 for used electric vehicles. The value of the credit depends on:

- Personal income

- Vehicle cost

- The sourcing of certain vehicle parts

A fairer energy system for all

The IRA dedicates billions of dollars towards programs that will address inequities in our energy system.

Investments include:

- $3 billion in Environmental and Climate Justice block grants,

- More than $11 billion for programs that will support clean energy in rural communities,

- $27 billion to establish a National Green Bank to benefit low-income and disadvantaged communities.

See this overview by Rewiring America for more details on these provisions.

Watch our webinar to learn more about the IRA

What’s included in the IRA and how it can help you, your neighbors, and the organizations you care about go solar.

Get the latest on solar straight to your inbox.

Fight for your solar rights.

Everyone has the right to go solar. Spread the sunshine nationwide and in your local community by taking action, joining events, and more.